Driving in my car over the weekend, I listened to one of John Mayer’s classic songs – Waiting on the World to Change. While the song does not address economics or the financial markets, I thought the title of the song was relevant when considering the world today. Determining precisely how events will unfold is anyone’s guess. But of more importance, it will be critical to watch for positive change at the margins. And with that said, the environment could certainly get worse before it gets better, especially for the U.S. economy. Last week, the FOMC raised the federal funds rate by .75% to a target range of 1.5% to 1.75%.1 This increase, the largest since 1994, was in response to elevated May CPI readings. At the press conference, Fed Chair Powell noted more increases in the federal funds rate would be forthcoming. At this point, the probability of a recession is high. Will the U.S. economy enter a recession? And if so, what will be its depth and duration? And the $64,000 question still relates to the path of inflation. When will inflation start to moderate? The answers to these questions will come in time, but until then, three economic scenarios should prove a useful guide.

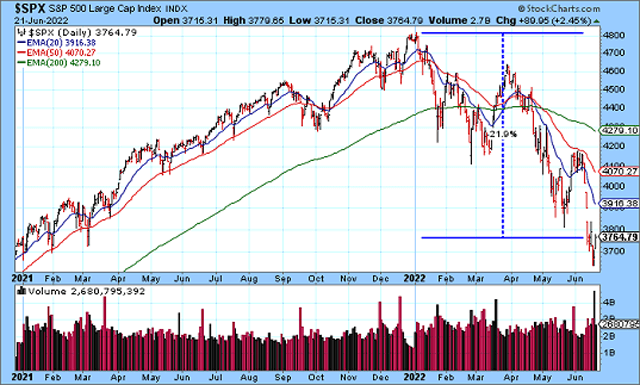

Reviewing the major U.S. stock market indexes, 2022 has been a difficult year. Shown below are the year-to-date returns as of June 21, 2022 (price performance, dividends not included).

| U.S. Stock Market Index | Year-To-Date Return |

|---|---|

| Dow Jones Industrial Average | -15.98% |

| Nasdaq Composite | -29.25% |

| Nasdaq 100 | -29.25% |

| S&P 500 | -21.01% |

| S&P 400 | -20.89% |

| S&P 600 | -20.72% |

Shown below is a chart of the S&P 500. Since the start of 2022, the index has been in a downtrend with a series of lower highs and lower lows. The index is down about 21.9% from its all-time high set in January 2022.

Reviewing the S&P 500 sectors via the SPDRs, the energy sector is the only standout based on higher oil prices and geopolitical concerns. Shown below are the year-to-date returns as of June 21, 2022 (price performance, dividends not included).

| S&P 500 Sector SPDR | Year-To-Date Return |

|---|---|

| Consumer Discretionary | -31.58% |

| Consumer Staples | -8.63% |

| Energy | 39.05% |

| Financials | -19.33% |

| Health Care | -12.71% |

| Industrials | -17.75% |

| Materials | -16.33% |

| Real Estate | -23.34% |

| Technology | -26.56% |

| Communication Services | -30.19% |

| Utilities | -7.77% |

In terms of analyzing the environment going forward, three economic scenarios are useful to consider – a soft landing, a softish landing, and a hard landing.

1. Soft Landing – This is the most ideal scenario whereby the Fed is able to slow the economy down enough to cool inflation without causing a recession. The classic example of a soft landing is the 1994 rate tightening cycle conducted under Fed Chair Greenspan. While this is the most ideal scenario, it is the most difficult given the Fed’s tools and policy lags.

2. Softish Landing – The term “softish” was used by Fed Chair Powell to denote a slowdown in the economy more severe than a soft landing but not as severe as a hard landing. A softish landing would involve a mild and short recession.

3. Hard Landing – This is the worst case scenario involving a deep and long-lasting recession. The classic example of a hard landing under inflationary conditions is the 1981-1982 recession under Fed Chair Volcker. This scenario could unfold if inflation proves highly persistent thus necessitating extremely aggressive Fed tightening.

In my January 20th article, I discussed the Fed’s hawkish turn in response to elevated levels of inflation. I highlighted the recession risk and noted the path of inflation as a key variable. While that article was written about five months ago, it is still as relevant today as it was then. However, what is different today is the probability of the three economic scenarios discussed above. Back in January, the soft landing scenario was a highly plausible outcome. Inflation, while high, was expected to moderate and people were optimistic the Fed would be able to cool inflation while keeping growth on track. Fast forward five months and the soft landing scenario is slipping away. Inflation is still high, the Fed is becoming more aggressive, and growth is in doubt. The current economic data does not look promising. The 2nd estimate for Q1 real GDP was -1.5%.2 Additionally, the estimate of Q2 real GDP provided by the Federal Reserve Bank of Atlanta was 0% as of June 16, 2022.3 While the soft landing scenario is possible, it is not looking probable. What is looking probable is a recession. What this leaves is the softish and hard landing scenarios. The question is what type of recession will we see – mild and short (softish landing) or deep and long (hard landing)? Based on the Fed’s increased vigor, I believe inflation will moderate over the coming months. Moreover, inflation has now become a white-hot national issue so I believe we will see a more holistic response to combat inflation. Provided inflation does start to moderate, the Fed can then pivot towards growth and the U.S. economy should recover fairly quickly. But with that said, the timing and trajectory are unclear and I would weight each scenario as equally likely at this point. Going forward, the path of inflation will remain a key variable. Until inflation starts to moderate, risks to the U.S. economy and equity market remain high.

Thanks for reading.

Phillip B. Kaiser, CFA, CFP®, CMT®

Notes

1. Board of Governors of the Federal Reserve System, Federal Reserve Press Release – June 15, 2022. Accessed on Wednesday, June 15, 2022 from https://www.federalreserve.gov/monetarypolicy/files/monetary20220615a1.pdf.

2. Bureau of Economic Analysis, Gross Domestic Product (Second Estimate) and Corporate Profits (Preliminary), First Quarter 2022. Accessed on Monday, June 20, 2022 from https://www.bea.gov/data/gdp/gross-domestic-product.

3. Federal Reserve Bank of Atlanta, GDPNow Model. Accessed on Monday, June 20, 2022 from https://www.atlantafed.org/cqer/research/gdpnow.