At the end of August, the U.S. concluded its 20-year war in Afghanistan. Images and videos of the withdrawal painted a dire picture of chaos, confusion, and suffering with the Taliban firmly back in power. Having served in Afghanistan while on active duty in the U.S. Air Force, I was not too surprised at the turn of events. In terms of emotions, the overriding feeling was one of disappointment given the many sacrifices made to improve the lives of the Afghan people. Subsequent reflection on my experiences in Afghanistan highlight a couple of fundamental problems I believe lie at the heart of what went wrong.

While the initial mission in Afghanistan was in response to the September 11th terrorist attacks, over time it evolved into one of nation building. From the American perspective, this is a desirable and idealistic goal. From the Afghan perspective, while certain segments of the population may have been open to American ideals and values, it is questionable as to whether our ideals and values were attractive to the population at large. This is especially true outside of city centers such as Kabul. While I worked with many Afghans, this does not necessarily mean we shared the same ideals and values, and in many cases we did not.

The second problem relates to practicality. The Afghans I worked with were practical and focused on day-to-day survival. Using financial terminology, the Afghan people hedged their bets by working with both the Americans and the Taliban. This provided the Taliban enough oxygen to survive, recruit, and regain power 20 years after their ouster. Despite our best efforts in terms of expertise, personnel, and resources, a fundamental difference in value systems along with the ability of the Taliban to “stick around” and outlast the U.S. resulted in the outcome witnessed.

While the withdrawal from Afghanistan is worrisome from a national security standpoint, what is a more immediate worry for investors is the withdrawal of monetary policy support enacted in 2020 in response to COVID-19. In response to a strengthening economy, the Federal Reserve (Fed) noted at its most recent meeting that a reduction in asset purchases may soon be warranted. Currently, the Fed is purchasing $120B in securities per month, consisting of $80B in Treasury securities and $40B in agency mortgage-backed securities (MBS). As for the size and timing of the reduction in asset purchases, specifics were not provided, although Chairman Powell noted the Fed was looking to end the tapering process in mid-2022. This endpoint would imply a reduction of about $15B – $20B per month using a reduction timeline of 6 – 8 months (November – January start data and June end date). However, the reduction may not be an even monthly amount and could start off small, say $5B or $10B per month, and increase in magnitude based on incoming economic data. Once the tapering process is complete, the next step outlined by the Fed will be to increase the federal funds rate (FFR). According to the Summary of Economic Projections1 provided at the September FOMC meeting, the Fed projects a median FFR of .3% in 2022, 1% in 2023, and 1.8% in 2024. This implies one interest rate increase in 2022, three interest rate increases in 2023, and three interest rate increases in 2024. The ranges provided for the FFR are also instructive in that they are fairly wide highlighting a large degree of uncertainty. For 2022 the range is .5% (.1% – .6%), for 2023 the range is 1.5% (.1% – 1.6%), and for 2024 the range is 2% (.6% – 2.6%). These ranges are simply too noisy to have much predictive value. The bottom line is a reduction in asset purchases seems likely in the near term given the strength of incoming economic data. Emergency measures put in place in 2020 served the economy well, but at this time do not appear to be justified. The intention was never to keep these measures in place indefinitely. However, a reasonable amount of uncertainty still remains regarding the economic outlook. As such, completely reducing asset purchases to zero in a month or two would not be prudent. The Fed will reduce its asset purchases in a measured manner over a period of time. While the reduction does represent a tightening of monetary policy, I believe the U.S. economy and equity markets will be fine. As for FFR increases, these appear to be in play in late-2022 and beyond as the economy continues to recover from COVID-19. However, one complicating factor is the path of inflation, as discussed below.

Reviewing the major U.S. stock market indexes, 2021 has been a good year. Shown below are the year-to-date returns as of September 28, 2021 (price performance, dividends not included).

| U.S. Stock Market Index | Year-To-Date Return |

| Dow Jones Industrial Average | 12.07% |

| Nasdaq Composite | 12.87% |

| Nasdaq 100 | 14.60% |

| S&P 500 | 15.88% |

| S&P 400 | 16.27% |

| S&P 600 | 20.60% |

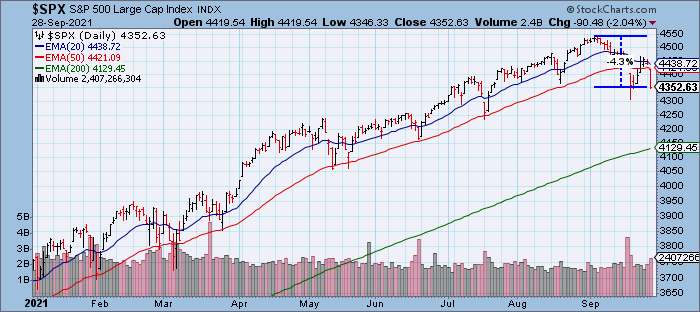

Recently, volatility has picked up based on a number of factors. Shown below is a year-to-date chart of the S&P 500, down about 4.3% from its all-time high.

Reviewing the S&P 500 sectors via the SPDRs, the energy, financials, real estate, and technology sectors have performed well in 2021. Shown below are the year-to-date returns as of September 28, 2021 (price performance, dividends not included).

| S&P 500 Sector SPDR | Year-To-Date Return |

| Consumer Discretionary | 13.91% |

| Consumer Staples | 4.87% |

| Energy | 44.20% |

| Financials | 30.89% |

| Health Care | 13.95% |

| Industrials | 13.75% |

| Materials | 12.91% |

| Real Estate | 25.49% |

| Technology | 16.48% |

| Communication Services | 19.82% |

| Utilities | 3.70% |

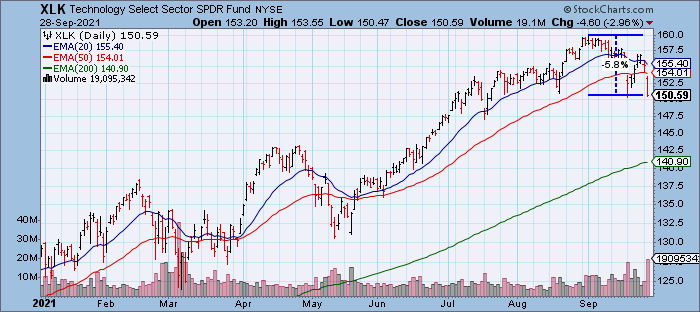

Shown below is a year-to-date chart of the technology sector SPDR. Over the last several years, the technology sector has been a top performer. In 2021, however, the technology sector has cooled off based on factors such as valuation and movements in interest rates. The technology SPDR is down about 5.8% from its all-time high.

As I survey the current environment, volatility has picked up based on a multitude of factors. In addition to seasonal weakness in September and October, the factors below are resulting in heightened market volatility. It will be important to keep an eye on these factors as they will impact the U.S. economy and equity markets.

1) Federal Reserve – Barring an unforeseen turn of events, the Fed is close to reducing its asset purchases. The market will want information on the reduction schedule and this information could come as soon as the November FOMC meeting. While I believe the U.S. economy and equity markets will survive the taper, what it will impact is the magnitude of gains going forward. Over the last year and a half, the U.S. equity markets have been extraordinarily strong on the back of stimulative monetary and fiscal policies. As these policies are curtailed, gains will moderate.

2) Inflation – Since the start of 2021, inflation has been trending higher. As measured by the CPI, prices increased 5.3% for the 12 months ending in August (4% increase in the core CPI). This compares to a 1.4% increase for the 12 months ending in January (1.4% increase in the core CPI). As a result of COVID-19, many markets were severely disrupted resulting in ongoing difficulties meeting demand with adequate supply. Shortages have developed and prices have increased. I tend to agree with the Fed in that much of the inflation should be transitory. As the world normalizes after COVID-19, price pressures should abate and supply should match demand. However, the issue is one of timing and response. How long will it take for the world to normalize and how will the Fed respond if inflation continues to remain elevated? Will the world normalize in one month, three months, six months? And what if inflation remains elevated or continues to move higher in the months ahead? Quantitative criteria have not been applied to the word transitory nor to the Fed’s average inflation targeting framework. Both are unclear and introduce significant uncertainty in the presence of actual inflation. Recent equity market volatility along with an increase in the 10-year yield to 1.53% in part reflect inflationary pressures, and potentially a Fed response.

3) Fiscal Policy – President Biden and the Democrats are working to pass a $1T infrastructure package along with a $3.5T spending package. While the impact of these policies will be spread out over time if passed, political wrangling could negatively impact investor sentiment. Additionally, changes in the tax code will have an impact on corporate profitability.

4) Debt Ceiling – The debt ceiling will need to be raised to avoid a government default. Given the current political environment, this process may pose more risks than in years past. Currently, the political environment appears to be a zero-sum game. This increases uncertainty and the risk of adverse outcomes for the U.S. economy and equity markets.

5) China – Based on recent events, China has taken a clear authoritarian turn. In addition, the Chinese company Evergrande appears close to collapse under mounting debt troubles. Risks related to China have increased materially over the last several years and overall U.S. relations with China have deteriorated. I believe the strategic rivalry between the U.S. and China will be a key feature of the geopolitical environment going forward.

Thanks for reading.

Phillip B. Kaiser, CFA, CFP®, CMT®

Notes

1. Board of Governors of the Federal Reserve System, Summary of Economic Projections – September 22, 2021. Accessed on Monday, September 27, 2021 from https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20210922.pdf.