Over the last couple of months, heightened volatility has been evident in the U.S. equity market. The precipitating factor appears to be the hawkish turn taken by the Federal Reserve in response to elevated levels of inflation. In remarks to the Senate Banking Committee in November, Federal Reserve Chairman Powell noted it was time to retire the word transitory when describing inflation. In addition, Chairman Powell noted the Fed would consider accelerating its bond tapering. These words were backed up by action at the December FOMC meeting. From an initial reduction of $10B per month in Treasury securities and $5B per month in agency mortgage-backed securities (MBS), the rate was doubled to $20B per month in Treasury securities and $10B per month in agency mortgage-backed securities (MBS). A notable development signaling a more aggressive monetary response to inflation.

Reviewing the major U.S. stock market indexes, 2022 has been challenging so far. Shown below are the year-to-date returns as of January 20, 2022 (price performance, dividends not included).

| U.S. Stock Market Index | Year-To-Date Return |

| Dow Jones Industrial Average | -4.47% |

| Nasdaq Composite | -9.53% |

| Nasdaq 100 | -9.03% |

| S&P 500 | -5.95% |

| S&P 400 | -7.13% |

| S&P 600 | -7.25% |

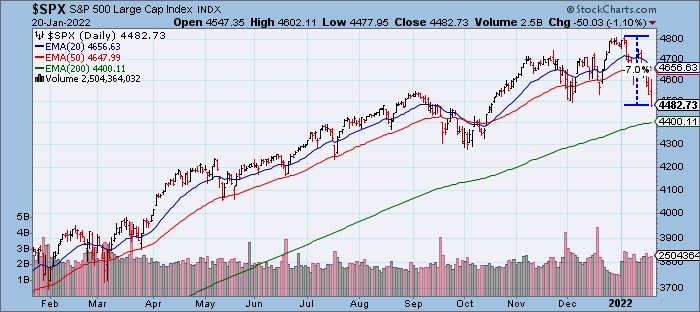

Shown below is a chart of the S&P 500. Over the last couple of months, the index has been volatile and range bound, reflecting uncertainty and indecision. The index is down about 7% from its all-time high.

Reviewing the S&P 500 sectors via the SPDRs, the energy sector is the only standout based on higher oil prices and geopolitical concerns. Shown below are the year-to-date returns as of January 20, 2022 (price performance, dividends not included).

| S&P 500 Sector SPDR | Year-To-Date Return |

| Consumer Discretionary | -9.08% |

| Consumer Staples | -1.57% |

| Energy | 14.79% |

| Financials | -.13% |

| Health Care | -7.17% |

| Industrials | -3.47% |

| Materials | -4.93% |

| Real Estate | -9.44% |

| Technology | -9.44% |

| Communication Services | -3.77% |

| Utilities | -3.65% |

The volatility we are witnessing is not too surprising given the current environment. As noted in my previous article, the lack of quantitative criteria applied to the word transitory and the Fed’s average inflation targeting framework introduces significant uncertainty. And this is where we are now. Inflation is high and as a consequence, uncertainty is high. As measured by the CPI, prices increased 7% for the 12 months ending in December, the largest increase since the period ending in June 1982 (5.5% increase in the core CPI, the largest 12-month change since the period ending February 1991). In response to inflation, the Summary of Economic Projections1 provided at the December FOMC meeting projects three increases in the federal funds rate (FFR) in 2022, up from one increase in 2022 per the September projections. Moreover, Chairman Powell noted the Fed may begin to reduce the size of its balance sheet in 2022. As opposed to the environment pre-COVID in which the Fed was able to keep monetary policy loose for an extended period in the presence of low inflation, the Fed will not be able to keep monetary policy loose for an extended period in the presence of high inflation. The Fed will need to act sooner rather than later. And this is where most of the real risk lies. The U.S. economy could be thrown into a recession if the Fed is too aggressive in combating inflation. The FOMC meeting next week will be important in terms of assessing where the Fed currently stands on inflation and what its policy actions may look like going forward. The path of inflation is a key variable and the equity market may remain choppy and volatile until inflation starts to moderate.

Thanks for reading.

Phillip B. Kaiser, CFA, CFP®, CMT®

Notes

1. Board of Governors of the Federal Reserve System, Summary of Economic Projections – December 15, 2021. Accessed on Tuesday, January 18, 2022 from https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20211215.pdf.